Experts Select Top High Dividend Japanese Funds for New NISA in Down Market

Money Consultant Taiki Yorifuji's Investment Course #2] "Japan High Dividend Stock Fund" that enables diversified investment in high dividend stocks with a single fund.

The New NISA, which has been revamped since 2024, is a system where taxes on investment income such as dividends, distributions, and capital gains are zero for a lifetime. The ‘lifetime’ tax-free status for investment income has made ‘high dividend stocks’ popular.

Through the New NISA, investing in bond funds, bond ETFs, REITs, REIT funds, and REIT ETFs allows you to receive regular cash flow from distributions. However, if you want to receive regular cash flow while aiming for capital gains, high dividend stocks are better.

Many people have started investing using the New NISA since its launch in 2024.

The market rose steadily in the first half of the year, but in August 2024, it experienced its first major crash. This was due to accelerated yen appreciation following additional interest rate hikes by the Bank of Japan, along with concerns about a potential slowdown in the US economy.

Nevertheless, even in a declining market, high-quality high dividend stocks tend to provide stable dividends, leading to increased demand from investors during downtrends. They are strong against overall market declines and tend to recover from downturns faster.

In this article, we will thoroughly compare ‘Japanese High Dividend Stock Funds,’ which offer easy diversification with just one investment.

How Can You Receive Dividends?

Dividends can be received from just one share and are distributed according to the number of shares held.

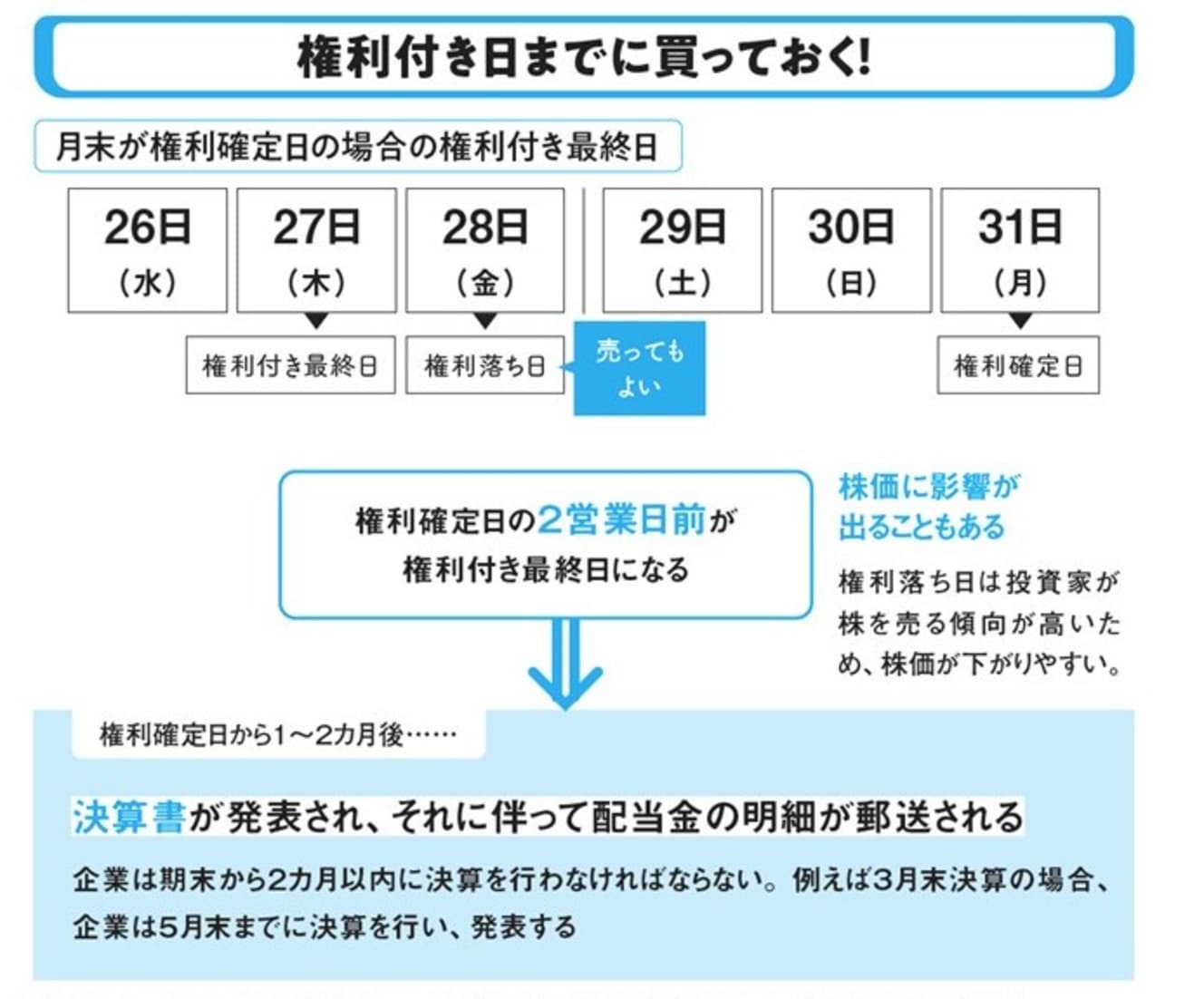

To receive dividends, shareholders must hold their shares until a specific date, known as the “Ex-Dividend Date.” If you hold shares on this date, you will be eligible to receive dividends and shareholder benefits. The actual receipt of dividends occurs about 2 to 3 months after the Ex-Dividend Date, starting from the “Record Date,” and can be withdrawn as cash at that time.

The day after the Ex-Dividend Date is called the ‘Ex-Dividend Day.’ From this day on, you can still receive dividends even if you sell the stock.

In reality, the Ex-Dividend Day tends to see investors selling stocks, which makes stock prices more likely to fall. Conversely, leading up to the Ex-Dividend Date, investors tend to buy stocks, making prices more likely to rise.

What Are High Dividend Stocks?

High dividend stocks refer to stocks with high dividend yields. The dividend yield is an indicator of how much dividend income you can receive annually relative to the current stock price. It can be calculated using the formula: “Annual Expected Dividend ÷ Stock Price × 100.”

A dividend yield above 3% is considered a “high dividend.”

For reference, the average dividend yield of Japanese stocks is as follows.

The average expected dividend yield for stocks included in the Nikkei Stock Average is 1.91%, while the average expected dividend yield for all Prime and Standard stocks is about 2.35%. It is understandable that a dividend yield over 3% is considered a high dividend.

Beware of Focusing Solely on High Dividend Yields

However, it is not advisable to jump at high yields alone.

The dividend yield formula is ‘Annual Expected Dividend ÷ Stock Price × 100.’ This means that if the stock price falls, resulting in a higher dividend yield, there is a possibility that the stock may be an unpopular one or a company with deteriorating performance.

If performance and finances deteriorate, not only might the company be unable to increase dividends, but it might also face ‘dividend cuts’ or, in the worst case, ‘suspension of dividends.’ This would further decrease the stock price and lead to a disastrous situation.

Focusing only on dividend yield and jumping at high dividend stocks could lead to a reduction in your assets.

It is essential to check whether the company’s performance is strong and its finances are sound.

Three Key Points for Quickly Selecting Quality High Dividend Stocks

There are about 4,000 companies listed on the Japanese stock market.

To choose high-quality high dividend stocks that can continue to provide stable high dividends in the future, but if you don’t want to spend too much time, it is recommended to search using the following three key points.

- Filter for Dividend Yields of 2% or Higher

If you search with the condition of “3% or higher” for dividend yields, you may miss out on quality stocks that are close to 3%. Stocks tend to become more expensive as they gain popularity, which results in lower dividend yields. Depending on the timing of your screening, you might overlook promising high dividend stocks.

Therefore, filter for dividend yields of “2% or higher” and then search for quality stocks within this range. Note that dividend yield is only an initial filter; other factors should also be considered.

- Focus on Stocks with “Consecutive Dividend Increases” or “Stable Dividends”

Dividend increases refer to raising the dividend per share compared to the previous period. Generally, dividends increase with good performance and decrease with poor performance. However, just because a stock is increasing its dividends doesn’t necessarily mean its performance is excellent. Still, stocks that consistently increase dividends over the long term are likely to have growing and improving business performance.

Additionally, stocks that maintain high dividend levels without increasing them are likely to have stable performance and management. By searching for stocks with “consecutive dividend increases” or “stable dividends,” you can more easily find promising candidates.

- Aim for a Payout Ratio of 30–50%

The “payout ratio” is an indicator that shows what percentage of a company’s net income is distributed as dividends. It can be calculated by dividing the total amount of dividends paid to shareholders by the net income for the period.

For example, if the payout ratio is 30%, it means that 30% of the net income is distributed as dividends to shareholders. A low payout ratio means less money is allocated for dividends, resulting in smaller dividend payments. However, such companies may be saving surplus funds for future growth.

On the other hand, if the payout ratio is between 70–90%, it means that more of the profit is being distributed as dividends rather than being reinvested in the company’s growth, which raises concerns about the company’s sustainability and growth prospects. The average payout ratio varies by industry, but a general guideline is to aim for around 30–50%.

If your investment strategy focuses on consistently receiving high dividends without aiming for capital gains, choose stocks from industries with stable performance and resistance to economic downturns.

Industries that are resilient to recessions include food, pharmaceuticals, electricity and gas, railways, and telecommunications.

There Are 36 High Dividend Stock Funds Eligible for the New NISA

Selecting high dividend stocks with strong performance and sound finances from 10 to 20 stocks might seem straightforward, but in reality, it can be quite challenging.

This is where “high dividend stock funds” come in handy. By purchasing just one fund, you can easily achieve diversified investment across multiple high dividend stocks. While “high dividend stock ETFs” are also an option, investment trusts (funds) are convenient because they allow for monthly investments in units of 100 yen or more, down to 1 yen.

According to the Investment Trusts Association’s list, as of July 29, there are 36 high dividend stock funds eligible for the New NISA.

As of the time of writing, only the “Nikkei Average High Dividend Yield Stock Fund” is available for investment through the accumulation investment framework. Funds available only through the growth investment framework are listed in order of the lowest trust fees.

In the paid version of [FRIDAY Subscription], six selected funds from the 36 high dividend stock funds eligible for the New NISA, along with detailed explanations and comparisons, are available.

For the full article, visit [FRIDAY Subscription] “Detailed Comparison of High Dividend Funds Eligible for New NISA by Financial Experts.”

Interview and text: Taiki Yorifuji

Money Consultant, Representative Director of Money & You Inc. Visiting lecturer at Chuo University's Faculty of Commerce. After graduating from Keio University with a degree in economics, he worked for a foreign life insurance company in asset management risk management. He is the author of the news media "Mocha," YouTube "Money&YouTV," podcast "Money Radio," and Voicy "5 a Day, 5 a Day, 5 a Day. He also provides fresh information on money through his podcast "Money Radio," podcast "Money Radio," podcast "Money & YouTV," YouTube, Voicy "5 Minutes a Day," books, and lectures. He has written 90 books including "Hajimete no Shin NISA & iDeCo" (Seibido Publishing Co., Ltd.), "Teireki Koto Zutto Kettle no Mawaranai Money no Hanashi" (Daiwa Shobo), and "Manga to Zukyu Hajimete no Asset Management" (Takarajima-sha), which has sold over 1.6 million copies in total. He is a member of the Securities Analysts Association of Japan. He is a licensed real estate agent. Financial planner (AFP). Member of Japan Society of Actuaries.