The Repeated Failures of the Bank of Japan and the Details of Governor Ueda’s Shocking Remarks

BOJ Governor Kazuo Ueda’s press conference stunned the market.

On August 5, the Nikkei Stock Average fell 4,451.28 yen, the largest drop on record, surpassing the drop recorded on the day after Black Monday in 1987, and more than 10,000 yen from its high on July 11, leading to global stock market declines. The main cause of this drop was the Bank of Japan’s interest rate hike, but it was BOJ Governor Kazuo Ueda’s press conference that stunned the market. An expert explains.

What was BOJ Governor Ueda’s “astonishing statement”?

At the monetary policy meeting held at the end of July, the BOJ raised its policy rate from 0-0.1% to 0.25%. The timing of the rate hike itself was unexpected by the financial markets, but the real surprise came from Governor Ueda’s remarks at the post-meeting press conference. He said , “If the BOJ’s economic and price outlook is realized, we will continue to raise the policy rate accordingly.

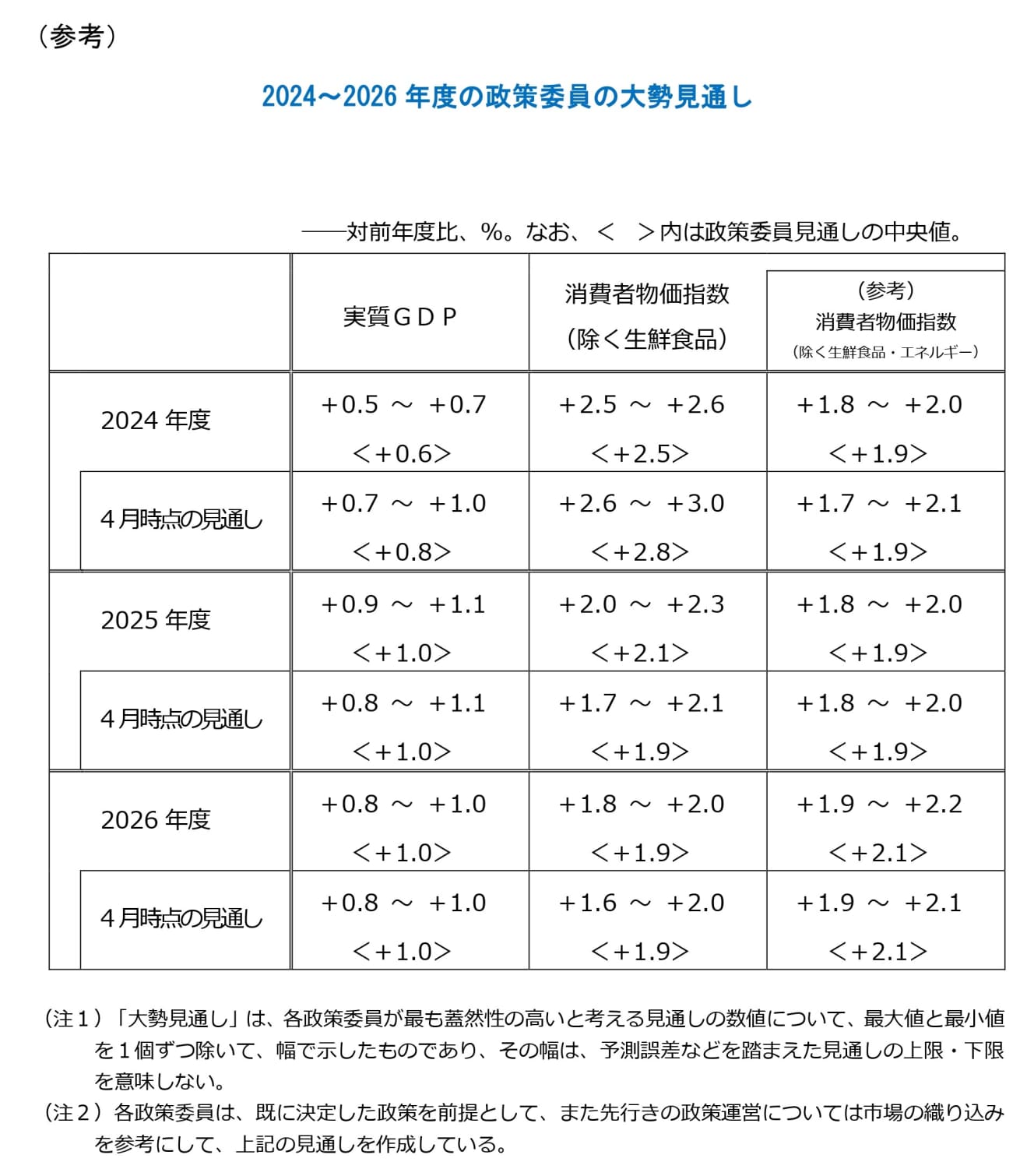

Why is this a “problematic statement”? It becomes clear when you read the BOJ’s Economic and Price Outlook. At the same time as the press conference, the BOJ released its “Outlook for Economic Activity and Prices (July 2012). In the document, “Policy Board Members’ Outlook for Fiscal Years 2024-2026,” the Bank of Japan’s policy board members’ forecasts for real GDP and the CPI (year-on-year) are listed.

The median real GDP forecast is +0.6% for FY24, +1.0% for FY25, and +1.0% for FY26. The consumer price index is +2.5% for FY 2012, +2.1% for FY 2013, and +1.9% for FY 2014. These projected values are not particularly unusual. The economic forecasts of major think tanks are similar to each other. However, this raises a major question: Why are they so completely “hawkish”?

Governor Ueda’s “hawkish” shift will lead to policy rate “to 1% at the end of next year

The reason is that Ueda’s statement above is a declaration that “if the Japanese economy continues to perform according to this average forecast, we will continue to raise interest rates. The hurdle for triggering a rate hike has become extremely low. Moreover, the statement also says that it does not consider the 0.5% policy rate, a level that has not been exceeded for the past 30 years, to be a “barrier.

The monetary policy authority’s advance statement of future monetary policy policy is called “forward guidance,” and it can be said that the Bank of Japan has issued an outrageous forward guidance.

As a result, the stock and bond markets were forced to make major revisions to their interest rate forecasts. The current scenario calls for two or three 0.25% rate hikes by the end of 2013, with two hikes bringing the policy rate to 0.75% and three hikes to 1%.

Monetary policy makers who are aggressive in easing monetary policy are sometimes called “doves” and those who are aggressive in tightening monetary policy are called “hawks. Governor Ueda, who had been perceived by the market as a hawk, appears to have turned into a full-fledged hawk.

Inflation target was “achievable with the status quo.” ……

The Bank of Japan’s stance has changed dramatically, and the discrepancies in monetary policy have become more noticeable. The BOJ has introduced an “inflation targeting policy. The policy target is to stabilize prices, and specifically, the target is a 2% year-on-year increase in consumer prices. Looking again at the BOJ’s price outlook, the inflation target will be achieved if prices continue to rise. If this is the case, then maintaining the current monetary policy is all that is needed.

Why should the BOJ raise interest rates now despite the fact that its monetary policy is working well? Moreover, if the BOJ’s forecast is realized, they will raise the policy rate further, but in that case, is there any risk of deviating from the inflation target? Unfortunately, there was no consistent explanation from Governor Ueda on these points, nor were there any questions from the press during the Q&A session.

BOJ Downplaying “Downside Risks” to the Economy

At the press conference, Ueda said, “One of the main reasons for raising interest rates is that it is better to make the adjustment a little early in order to achieve the 2% price target in a sustainable and stable manner. However, again, no clear rationale was given as to why the adjustment should be made earlier.

On the other hand, regarding the risk of rushing to raise interest rates when there is no problem, he reiterates that “real interest rates remain substantially negative, so the accommodative financial environment will be maintained, and the impact on the economy will not be large. The real interest rate is the nominal interest rate minus the expected inflation rate, and while it is true that the real interest rate has been significantly negative, we wonder if he is not underestimating the downside risk to the economy too much.

At the press conference, the BOJ repeatedly referred to its concern over the yen’s depreciation, which has caused prices to rise, and this seemed to be a strong motivation for the latest interest rate hike. Although foreign exchange policy is outside the BOJ’s jurisdiction, the BOJ has put monetary policy in charge of responding to the yen’s depreciation. In the first place, the weak yen was the driving force behind the Japanese economy’s escape from deflation. Although there may have been pressure from politicians and consideration for public opinion, this is a risky move.

Is this the beginning of the “Ueda recession?” ……

This series of moves is undeniably reminiscent of the Bank of Japan’s lifting of its zero-interest-rate policy in August 2000. The BOJ introduced its zero-interest-rate policy in February 1999, but lifted it in August 2000. However, at that time, the IT bubble had already begun to burst and stock prices in major countries were in the process of plummeting. Therefore, six months later, in February 2001, the BOJ was forced to cut interest rates again.

In fact, dark clouds are currently hanging over the U.S. stock market as well. Recently released U.S. economic indicators have been deteriorating rapidly, and along with fears of a recession in the U.S. economy, the possibility of the “AI bubble” or “EV bubble” bursting is being discussed.

The lifting of zero interest rates in August 2000 was a clear failure. The Bank of Japan’s interest rate hike in July may be a repeat of that event. Coincidentally, one of the two BOJ commissioners who opposed the lifting of zero interest rates in August 2000 was the current BOJ governor, Ueda. In order to avoid a “Ueda recession,” which could lead to a return to deflation, the BOJ should learn from the lessons of the past and quickly change course.

Interview and text by: Kenji Matsuoka

After working as a money writer, financial planner, and market analyst for a securities company, Kenji Matsuoka became independent in 1996. He writes articles on finance and asset management mainly for business and economic magazines. Author of "A Textbook for the First Year of Robo-Advisor Investing" and "Understanding with Rich Illustrations! The Book of Absolute Benefit from Cashless Payments".