Best “Robo-Advisor” According to Thorough Research of 8 Major Robo-Advisors Revealed!

Must-see! Thorough research on 8 major companies. Potential market size is 30 trillion yen! Optimal solutions for stock selection, trading, and rebalancing based on big data!

There are probably many people who are reluctant to start investing, saying, “I want to start investing, but I am afraid because I have no experience or knowledge. There is a service that allows such beginners to easily start professional-level asset management. Yasuhiko Fukano, a financial planner, explains.

It is “Robot Advisor” (commonly known as “Robo-Advisor”). Robo-Advisor is a service in which you answer multiple questions about your risk tolerance, asset status, etc., and the AI will suggest an asset management plan. The appeal of Robo-Advisors is that they can reduce risk through broadly diversified investments and long-term accumulation.

Roboadd’s greatest strength is that its AI, which learns big data on the investment market and the latest financial algorithms, handles everything from buying and selling to rebalancing (adjusting the ratio of investment allocations that change as the market moves up and down) on behalf of the user. The service is also popular for its ease of use, with some services starting at as little as 1,000 yen. The number of users is rapidly increasing both in Japan and overseas, and the potential market size is estimated at 30 trillion yen. Financial advisor Genki Ishihara says, “The market is growing rapidly both in Japan and abroad, and the potential market size is estimated to be 30 trillion yen.

It is recommended for those who are too busy with work to keep an eye on the market, as it offers diversified investments in stocks, gold, and bonds. It is also suitable for people who have experience and interest in investing but cannot make bold purchases or cut their losses, and it doesn’t work for them.

Those who meet the following three criteria should seriously consider adopting this system. (1) have surplus funds, (2) want to manage their assets for the long term, and (3) save their monthly salary. If all of these apply to you, you may want to start a robo-advisory service.

Which company offers the best robo-advisory service? The table on the next page summarizes the features and advantages of the eight major companies. The shortcut to success is to choose a robo-advisor that best suits your asset situation and lifestyle. Let’s take a look at them one by one while listening to the experts’ explanations below.

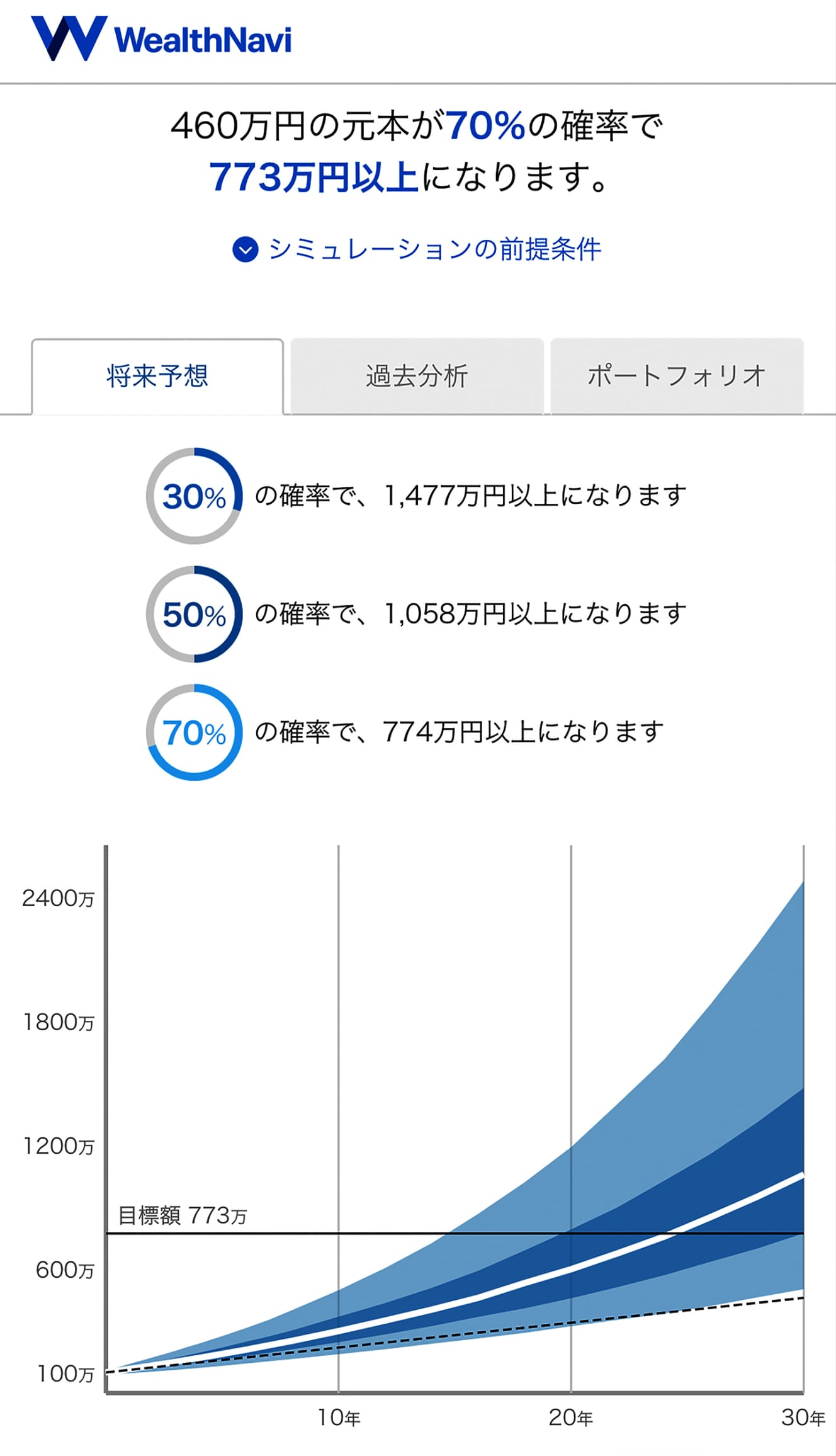

The largest robo-advisors in the industry are WealthNavi The largest robo-advisor in the industry is “WealthNavi. WealthNavi has a strong track record, with over 650 billion yen in assets under management. The company has been performing well, with returns up to February 2010 exceeding 50% in yen terms. Another attraction of the company is that it handles 11,000 stocks from about 50 countries.

The company is also the first in the robo-advisory industry to offer a service that is compatible with the NISA (small amount investment tax exemption) system. If you choose the “Omakase NISA” course, you can invest up to 1.2 million yen per year tax-free, which is very economical,” said Fukano.

The problem is that the commission rate for self-management is around 0.5%, while the robo-advisor’s commission rate is around 1%, which is relatively high. Those who want to keep commissions low can choose from the industry’s second-largest service, “THEO +”, with 133.1 billion yen under management. THEO + docomo,” which is the second largest in the industry with 133.1 billion yen under management. Fees range from 0.715% to 1.10% of assets under management. Mr. Fukano continues.

The “Automatic Tax Optimization Service,” which offsets profits and losses in transactions, reduces taxes. Since it is done automatically, there is no hassle. The service is ideal for those who use a docomo line or who have accumulated d-points, as d-points are awarded according to the amount invested.

SUSTEN has been attracting attention for its revolutionary fee structure. Shintaro Sakamoto, director of Kokorotrade Kenkyusho, says, “It’s called ‘profit sharing.

We use a complete performance-based fee system called “profit-sharing,” which means that we pay you when you make a profit. This is a system that pays a fee when a profit is made, and while many companies charge a commission of around 1%, “SUSTEN” charges a fee as long as no profit is made. In the case of “SUSTEN,” it is free as long as there is no profit.

If you want to start robo-advisory with a small amount of money, “ON If you want to start robo-advisory with a small amount of money, “ON COMPASS” is the best choice. The minimum investment is 1,000 yen, the lowest in the industry. It is also nice to know that there are no cancellation fees or other fees other than management fees.

Currently, the global financial markets are unstable due to Russia’s invasion of Ukraine. Those who are concerned about the violent ups and downs of the markets may want to try “Raku Wrap.

With “Raku Wrap,” asset allocation is rebalanced once every three months. For example, if stocks are going up, the system corrects it by selling some of them to lock in profits and investing in bonds. In addition, it also has a ‘decline shock mitigation function. This function reduces the blurring of overall asset price movements by temporarily lowering the investment ratio in stocks and increasing the investment ratio in bonds when the stock market is expected to continue to experience large price movements. When the price movement calms down, it automatically returns to the normal allocation,” says Ishihara.

FOLIO ROBO PRO” makes the best use of big market data. ROBO PRO” makes the most of big market data. It collects 40 types of market data, including stocks, bonds, currencies, and precious metals from around the world, and its AI predicts returns. It is suitable for those who want to invest widely and learn.

If you are worried about leaving everything to AI, “Daiwa Fund Wrap ONLINE” is a good choice for those who are worried about leaving everything to the AI. If you have any concerns about investment, you can consult with a branch office of Daiwa Securities. It also has an automatic savings function, making it perfect for long-term investments.

The Hybrid” is a “robo + human” service, with a double-checking system that includes professional monitoring of the AI’s portfolio and investment status.

Mr. Ishihara, mentioned above, says, “No matter which company’s service you use, you can be sure of the quality of the service.

Regardless of which company’s service you use, it is important not to try to make a profit all at once. The strength of AI is that it can derive optimal solutions from big data, but the market can also betray predictions. If you start with 100,000 yen and accumulate it steadily every month, you should be able to make a profit if you invest with an eye toward building a large asset portfolio over the next 5 to 20 years.

The learning ability of AI is rapidly evolving, and the day may soon come when robo-advisors will dominate the financial market.

From the April 22, 2022 issue of FRIDAY

PHOTO: Afro