Do you need it after all? In the end, do you need it or not? Ask an expert about the current status of “stamps” under the “Electronic Bookkeeping Act.

I have no idea what any of this means…

Electronic transactions and electronic data storage” became fully obligatory from January 2012 under the revised “Electronic Bookkeeping Law.

What I don’t understand there is the issue of “imprinting”.

Experts say that electronically created invoices do not require a seal, but most companies require a seal. I can understand if it is an electronic seal because it is not possible to drop it on paper, but a letter typed inside a circle in an Excel “graphic” is OK. …… I don’t understand what the point of this is at all.

Four years after Taro Kono’s declaration of the “abolition of stamps in administrative procedures,” is the trend away from stamps taking root in the general corporate sector? We asked Toshiaki Okada, a licensed tax accountant, about the current status of hanko.

Too much work twice, too much shit.

How much has the computerization of accounting work reduced your workload? I picked up the stamp situation in the field from X. ……

I wish everything could be done electronically, but it’s too much of a hassle to print out a paper copy, stamp it, and hand it to the accountant, while saving it electronically.

I’m serious, but I’m going to spend 100 million yen on “the paper/stamp culture will never go away for office workers.

Japan has been talking about “getting rid of stamps,” but with the start of the invoice system, registration number stamps starting with “T” have been selling like hotcakes. Japan is truly a wonderful country.

I appreciate the fact that the documents I ask for stamps are stamped with a stamp, but many young people send me black-and-white scans of their documents, and it’s really bothering me as a company employee.

In a word, it’s a big mess! I can only say, “I can only say, “I can understand your difficulty. ……

The government has been “stamp-less” for a long time now!

In the first place, the reason why people are discussing the abolition of stamps is definitely because they are ‘an obstacle in the way of creating a digital society.

For example, in the case of taxes, it was a legal requirement to affix a seal when filing a tax return, and Taro Kono’s statement in 2008 to ‘abolish stamps in administrative procedures’ was a big step to deny this.

In other words, the government was moving hard toward the abolition of the seal for the sake of digitization, regardless of whether it was a good thing or a bad thing.

The government’s move was triggered by Kono’s statement, and now 99% of administrative procedures no longer require a seal.

When I talked to an acquaintance of mine who works at a certain city hall , he replied, “You are talking about stamps now? It has been abolished in a large part of the city halls. I don’t have any trouble because of it, and it was probably overkill for everyday administrative services and applications for residence certificates and the like. Everyone thought it was unnecessary, but they didn’t want to be the one to initiate it, so they took advantage of the situation and said, “Well, that’s enough, isn’t it? So I guess they decided to just go ahead and do it all at once. I received an upbeat reply.

Incidentally, he is now using a ” shachihata” (a small stamp with a small signature) to affix his seal because signing is a hassle! He is using it as follows.

If this is the case, why is there still a lack of progress in companies in general?

In Japan, since the establishment of the Meiji government, the use of hanko has permeated not only government administration but also people’s lives. It must have been quite a shock for the people to suddenly be told that they no longer need a stamp after having been established for more than a hundred decades.

The government can simply say, “It is discontinued,” but a company has its clients. Even if we abolish the stamp, if there is a difference in temperature on the receiving end, it will be a source of trouble.

In fact, if a document without a stamp is sent as a PDF file, the recipient may ask, “Is this a legitimate document? Or is it a sample and the real one will come later?” or “Since they still ask for a stamp, let’s just print it out already. The situation continues to be difficult because of the deep-rooted perception that a stamp is something that has been stamped as a practice of the corporate culture.

Is the stamp on a “request for approval” a symbol of Japanese democracy?

A stamp is just a stamp, but it is still a stamp. The reason why the hanko has not disappeared no matter how much digitization has progressed can be attributed to the fact that the hanko still plays a major role not only in the conventions of corporate culture but also in its necessity as a tool.

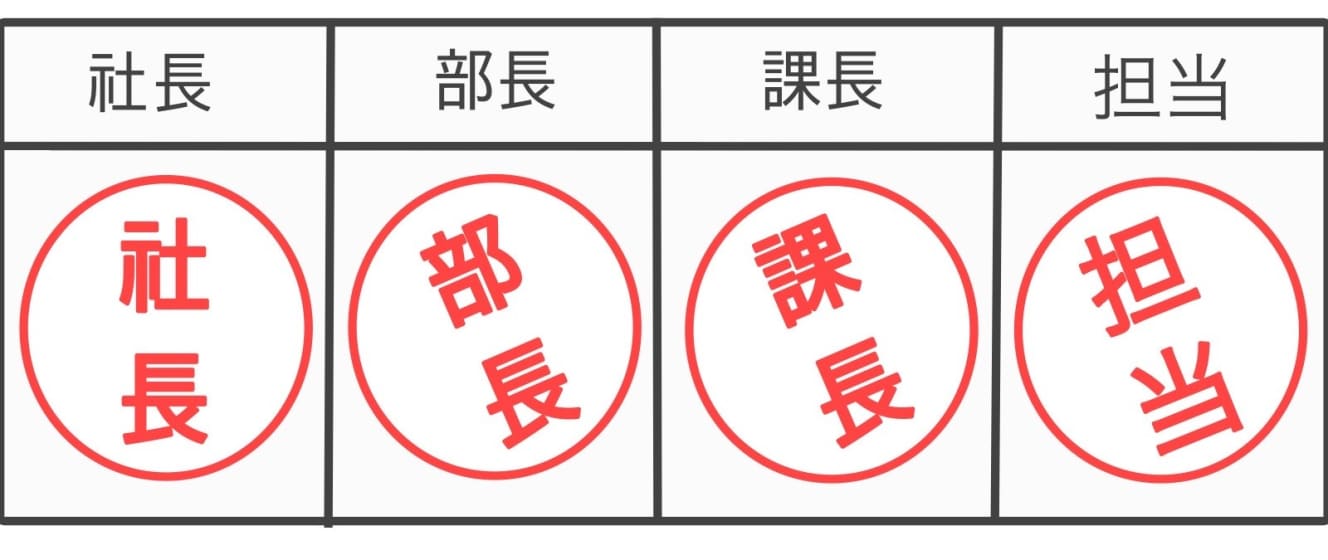

In Japan, there is a unique way of approving decisions, called “seiri-seiri,” which involves the use of a hanko (stamp).

When a company is trying to streamline its operations and improve efficiency, it is important to avoid the use of stamps. as much as possible. But if there is any kind of fraud in the company, it is better to have no such thing. However, it would be a problem if fraudulent practices were allowed to go on in the company, so I think that the stamp was an important way to draw a line in the sand.

In fact, the stamp may be a weapon as a way of building up from the bottom, so to speak, as part of democracy.

There is an argument for omitting the decision-making process: “Is it good to have an organization where the top management can just make a decision and then it’s done? It is a delicate question whether the approval process will become unnecessary as the paperless system advances in the future. There will always have to be an alternative.

I see. …… I understand! Let’s move forward with de-hanko for the time being, “Is it OK that there is no stamp on this?” It seems to me that the quickest way to eliminate the difference in temperature between the two is to send a declaration of the abolition of the hanko to all the relevant parties. Then, why don’t we send a request for approval to the company and pile up the stamps from the bottom to the top? No?

New forgeries, the digital divide ……, and problems are piling up!

We are now in a transitional period of transition to digital, and there is no denying that we are being swamped by repeated trial and error. Moreover, digitalization is not only a good thing, but also comes with its own set of dangers, according to Okada.

For example, from the point of view of tax inspectors, handwritten receipts are easy to spot if they are fraudulent.

For example, from the tax inspector’s point of view, a handwritten receipt is easily recognized as a fraud. For example, from the tax inspector’s point of view, it is easy to tell if a handwritten receipt is bogus.

However, when the system goes digital, such analog fraud is no longer possible, but instead, techniques are required to detect evidence of alteration of digital documents. It is also necessary to track the history of data creation, so a battle against new technologies will arise in the future.

When you go digital, it becomes easier to cheat. Even for invoices, a large scale fake invoice factory has been exposed in France.

Speaking of invoices, there are about 150 countries in the world that have introduced value-added tax, but Japan was the only one that did not introduce invoices for a long time.

This is not because Japan was late, but because it had developed its own unique method, according to Okada. He believes that no other country in the world is capable of keeping proper books of account like Japan.

Because of this, Japan introduced invoicing while leaving the bookkeeping system in place. Tax accountants and accountants are now forced to be bound by the double bind of old-fashioned ledgers and invoices.

And one more thing. If digitization continues at this pace, there will naturally be the problem of a digital divide.

Those who miss the boat are often born into the lower income brackets. The electronic compulsion is combined with the problem of economic poverty.

At the same time, there are people who belong to the intellectual class who say they will never lose their stamps and will never get on board with digitalization. We cannot afford to exclude those people.”

Paperless is certainly the trend of the times, but once again, when we talk about hanko, we are talking about something really profound, including its background.

Recently, Westerners who come to Japan want to make stamps,” he says. To take it to the extreme, if you say, ‘This is my hanko,’ it doesn’t matter if it’s a potato print or a cute animal.

For example, young people would stamp such a stamp instead of signing their names. It is quite possible that this will spread as a new culture, and it may even influence adult society. You never know what will happen.

I think I will never become old-fashioned, because the hanko is familiar to the Japanese and has a long history. Even in the business world, it’s hard to say exactly what to do. And I can’t say what is right either.”

Toshiaki Okada is the director of the Shirai Tax Accounting Office and a former adjunct professor at Aoyama Gakuin University. He is also the chairman of the Tokyo Tax and Fiscal Research Center and a former special national tax inspector. He is the author of “32 Points on Inheritance and Tax Practice” (Nippon Kayaku Shuppan, 2019), co-author of “Reform of Tax Administration” (Keiso Shobo, 2002), “Personal Information Naked My Number is Not Needed” (Otsuki Shoten, 2016), “Tax Law of Typical Contract: Tax Law for Lawyers x Tax Lawyers for Civil Law” (Nippon Kayaku Shuppan, 2018).

Interview and text by: Chimasa Ide PHOTO: Afro (1st photo)