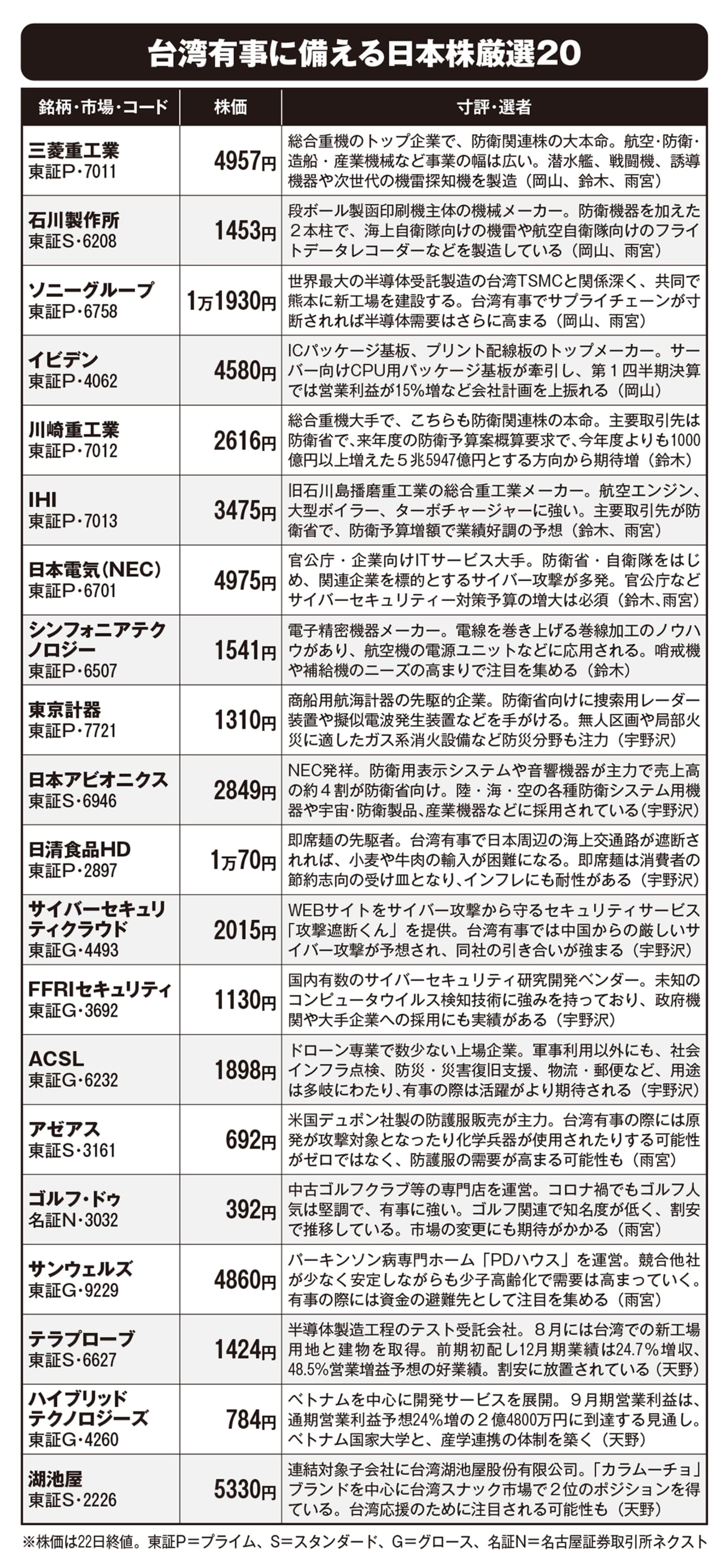

20 Stocks That Will Rise in the Event of a Taiwan Emergency

Sudden tensions in East Asia. Defense stocks such as Mitsubishi Heavy Industries, Sony semiconductors, and drone-related stocks are also attracting attention.

The Japanese stock market, which had been soaring toward the 30,000-yen mark of the Nikkei 225, has suddenly reversed course. One of the reasons for this is the “Taiwan contingency. It is clear that this is no longer a fire on the opposite shore, as a Chinese missile during drills landed only 80 km away from Yonaguni Island in Okinawa. Given these geopolitical risks, some institutional investors have been pulling out of Japanese equities.

On the other hand, it is true that some companies attract attention when diplomatic tensions rise. In this issue, we asked investment professionals to list stocks they would like to know about in times of emergency.

First, defense-related stocks. At a press conference held on August 10, following the inauguration of the second Kishida cabinet, the prime minister stressed the need to drastically strengthen defense capabilities. The prime minister’s comments were made in anticipation of a contingency in Taiwan, and some related issues saw their prices rise in response. Kazuyuki Suzuki, a stock analyst, commented, “The increase in defense spending will surely lead to an increase in the price of stocks in the market.

The three companies that will surely benefit from the increase in defense spending, Mitsubishi Heavy Industries, Kawasaki Heavy Industries, and IHI, cannot be overlooked. In particular, Mitsubishi Heavy Industries has expanded by taking over the technology and human resources of small and medium-sized defense-related companies that went bankrupt in the past due to declining demand, and has become the leading outsourcing provider. In addition, as tensions over armed conflict spread, the need for patrol and supply aircraft will increase. In this regard, we will be watching the price movements of Sinfonia Technology, which has strengths in wire winding processing and is involved in power supply systems for aircraft.

Cyber Defense” Becoming a Trend

As the saying goes in the market, “there is no selling in national policy,” and defense stocks are certainly a genre to hold onto, but in recent years the cyber field has also become important. During this year’s invasion of Ukraine, it came to light that Russia had launched a cyber attack prior to the military offensive. In light of this, Japan is likely to focus on cyber defense as a joint effort by the public and private sectors.

Shigeki Unozawa, a securities analyst, said, “FFRI Security is a domestic cybersecurity company.

FFRI Security is almost the only company with a proven track record in cybersecurity R&D in Japan. It has a proven track record of adoption by government agencies and major corporations, and should play an important role in the fight against cyber attacks, which are expected to intensify. Similarly, demand is also expected to increase for security services that utilize AI technology from Cyber Security Cloud.

In the defense sector, drones are also increasing their presence. In this case, however, the expectation is not for military use, but for use in infrastructure maintenance. Mr. Unozawa continues.

ACSL, which has a business alliance with Japan Post, provides drone services focused on infrastructure inspection, distribution, and disaster prevention. In the event of a contingency, the risk of distribution stoppages will be created, and there will be high expectations for the use of drones.”

Taiwan is at the frontier of semiconductor development, with TSMC, a semiconductor company with the largest market share in the world. If the Taiwan contingency were to escalate to the point that the semiconductor supply chain is disrupted, more investors would shift to shares of Japanese companies with advanced technology.

Demand may rise for Sony Group, which plans to build a joint venture semiconductor plant with TSMC in Kumamoto. Another semiconductor-related stock to keep an eye on is Ibiden, a top manufacturer of printed wiring boards used in all kinds of electronic devices, including PCs, and it has maintained strong performance, beating company estimates in its August earnings announcement,” said Marketbank representative Norifumi Okayama. (Mr. Norifumi Okayama, Representative Director of Market Bank).

Finally, are there any “surprising stocks” whose share prices may rise in connection with the Taiwan emergency? Kyoko Amamiya, an economic journalist and representative of the Amamiya Research Institute, says, “Not only in Taiwan, but also in other countries where a contingency may occur.

When a contingency occurs, not only in Taiwan, defensive stocks with stable performance tend to be bought as a place to evacuate funds. One such undervalued stock is Golf Do, which operates a used golf club specialty store; its e-commerce site has growth potential, but it seems to be an under-the-radar golf-related stock, making it a treasured defensive stock.

Market advisor Hideo Amano recommends the following stocks.

I am focusing on KOIKE-YA,” he said. KOIKEYA has a consolidated subsidiary in Taiwan and actually holds the second largest share of the snack market in Taiwan, mainly with its Karamucho brand. There is no possibility of a ‘support buy.’

In addition to gains on sales and dividends, investing in stocks is an effective way to gain insight into international affairs.

From the September 9, 2022 issue of FRIDAY

PHOTO: AFRO Kyodo News